Managing your finances can be a daunting task, especially when it comes to keeping track of all your payments. That’s where a printable payment log comes in handy. With a payment log, you can easily track all your payments in one convenient place, helping you stay organized and in control of your finances. In this article, we’ll explore the benefits of using a printable payment log and provide tips on how to create and maintain one effectively.

One of the main benefits of using a printable payment log is that it allows you to see all your payments at a glance. This can be especially helpful for budgeting purposes, as you can easily track where your money is going each month. Additionally, a payment log can help you avoid missed payments and late fees by providing a clear record of when payments are due. It can also serve as a valuable tool for monitoring your spending habits and identifying areas where you can cut back.

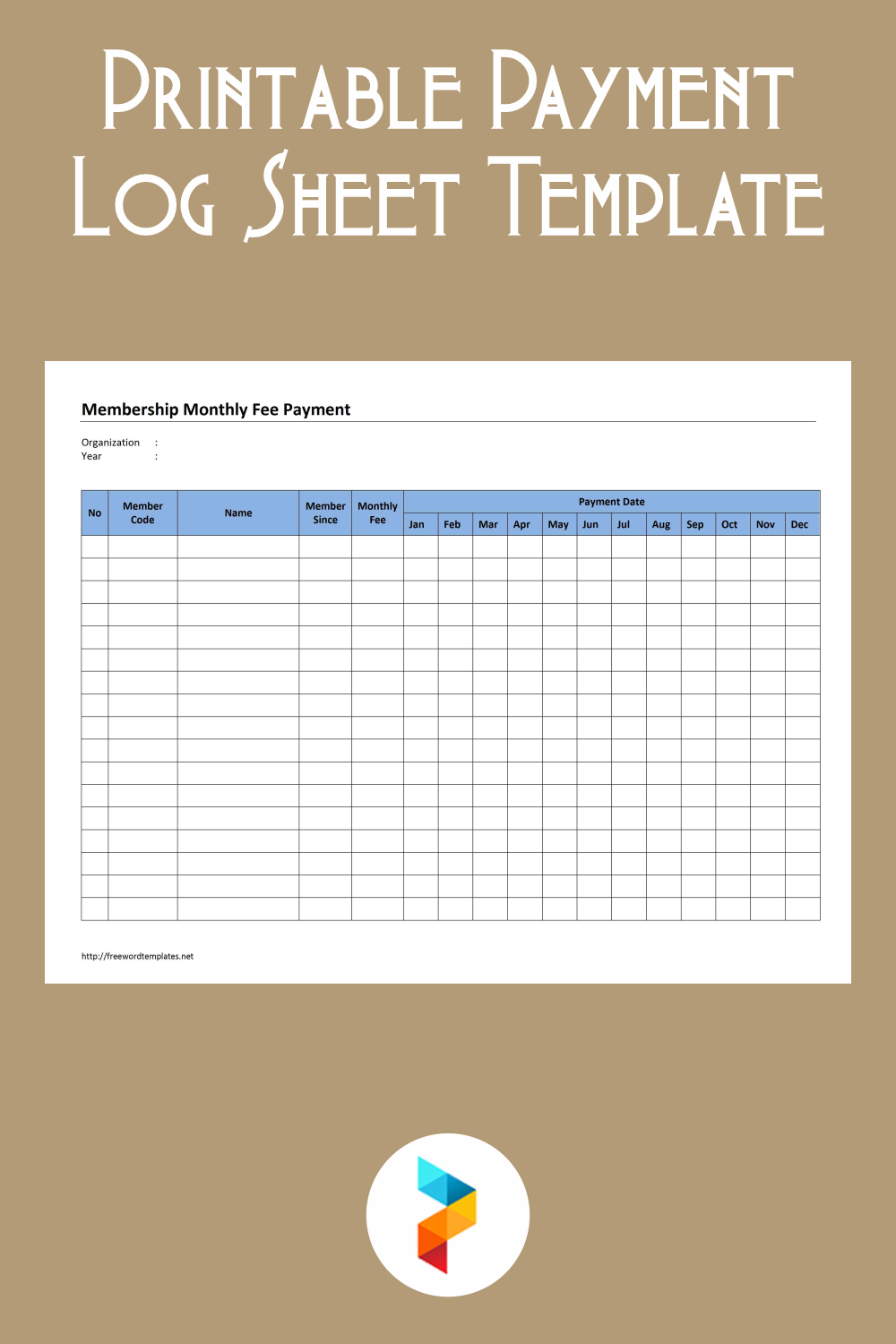

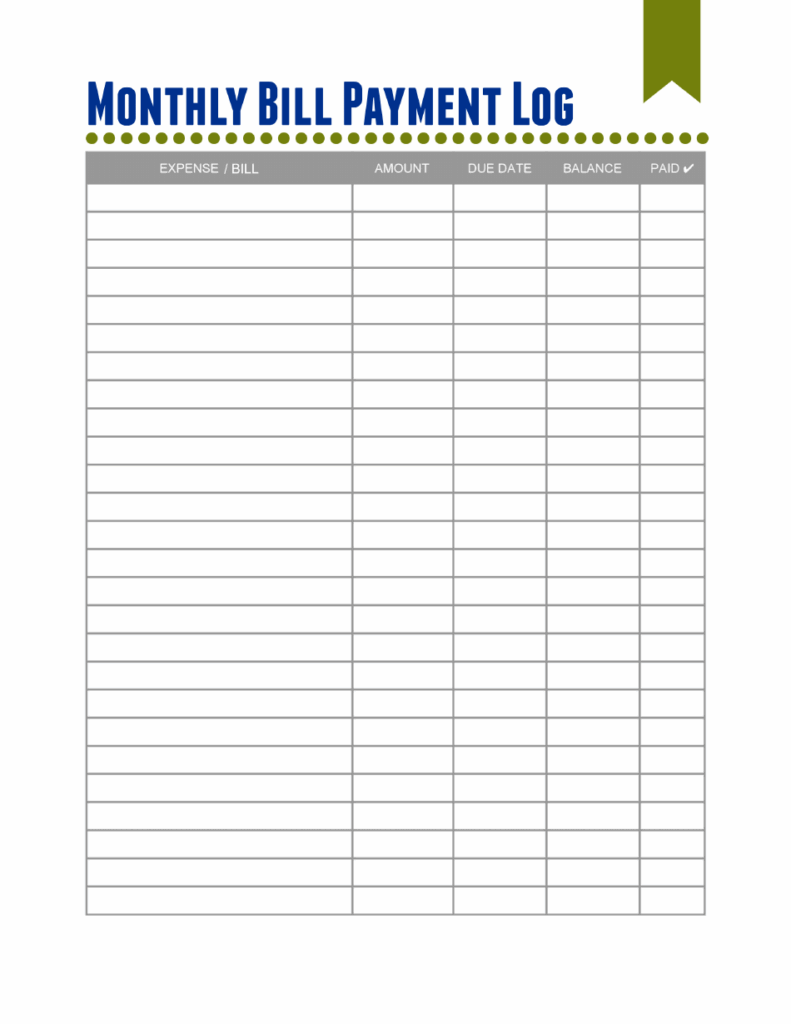

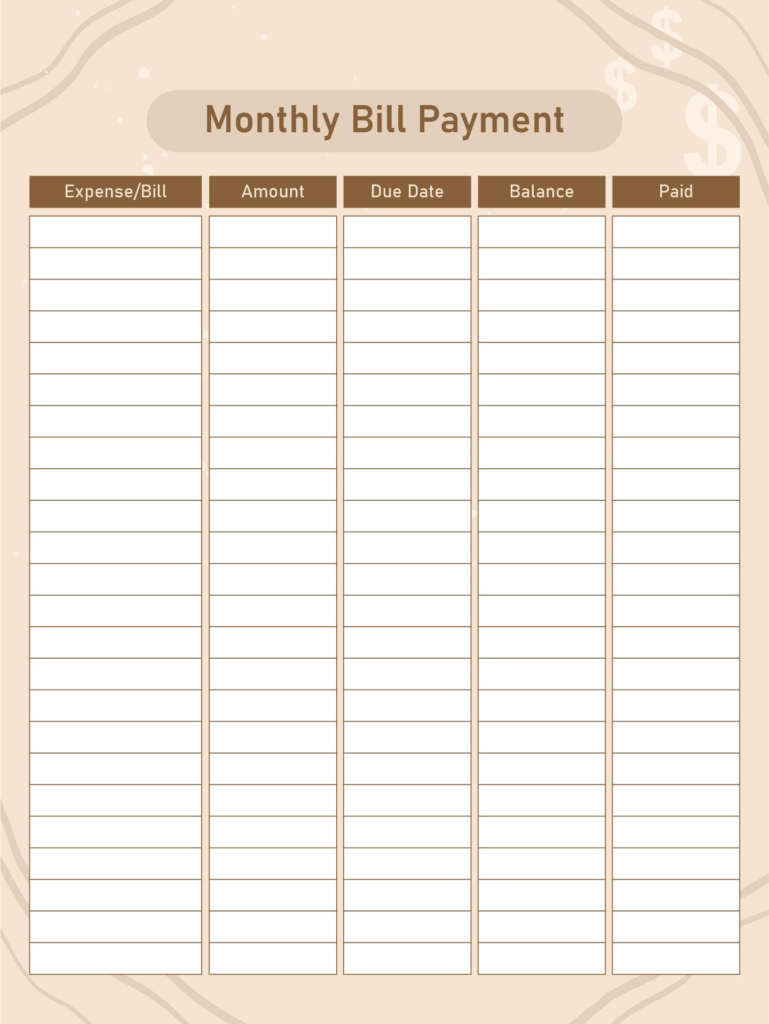

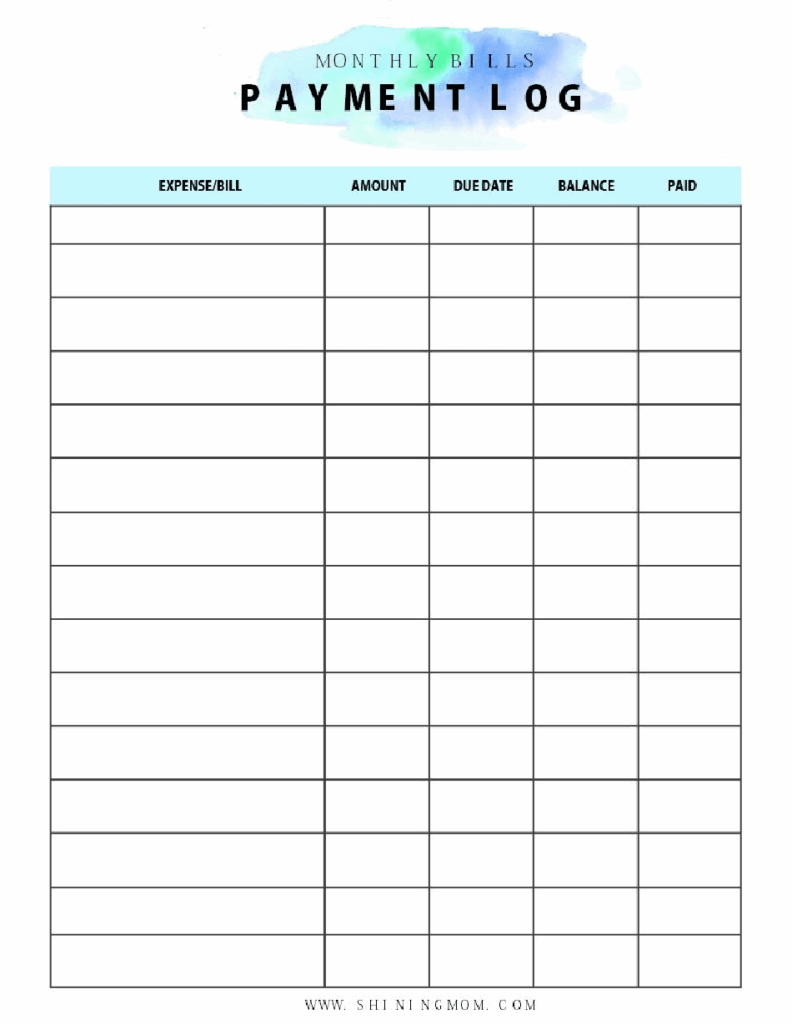

How to Create a Printable Payment Log

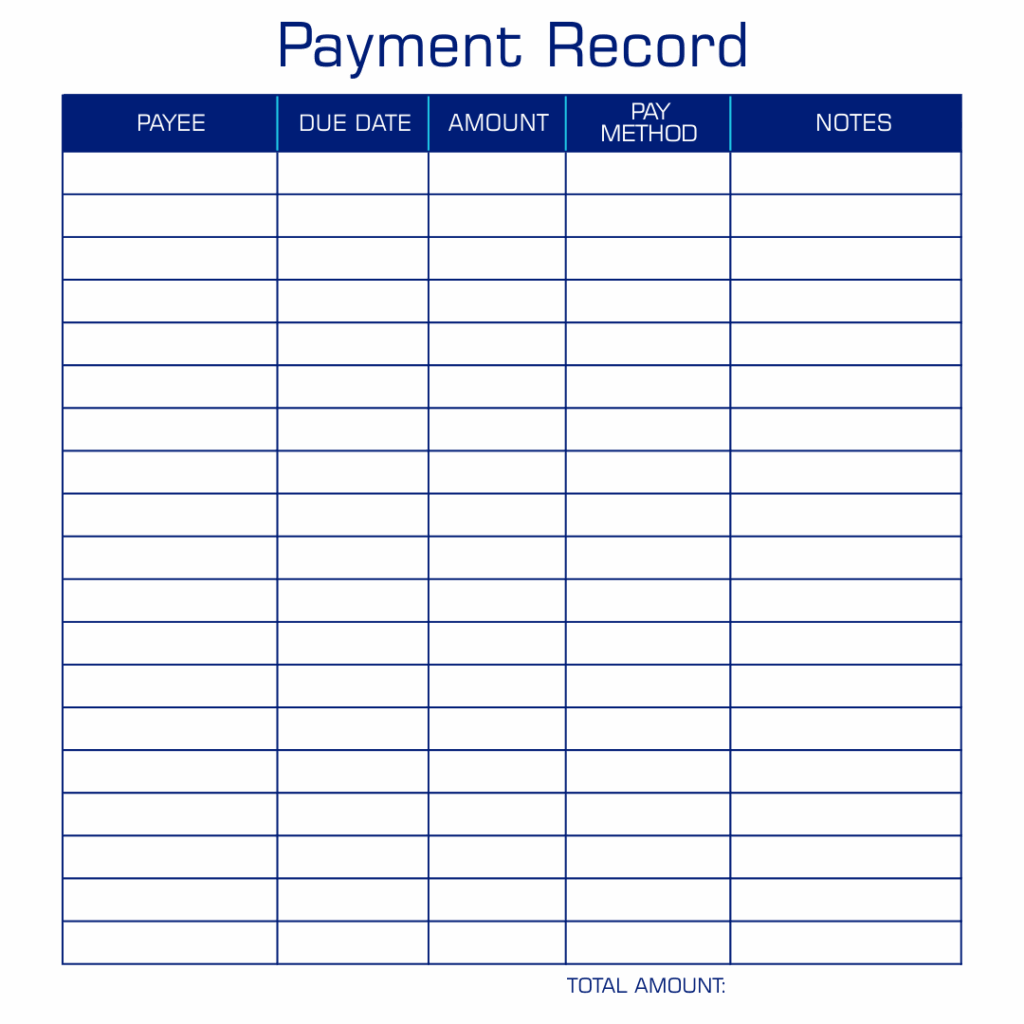

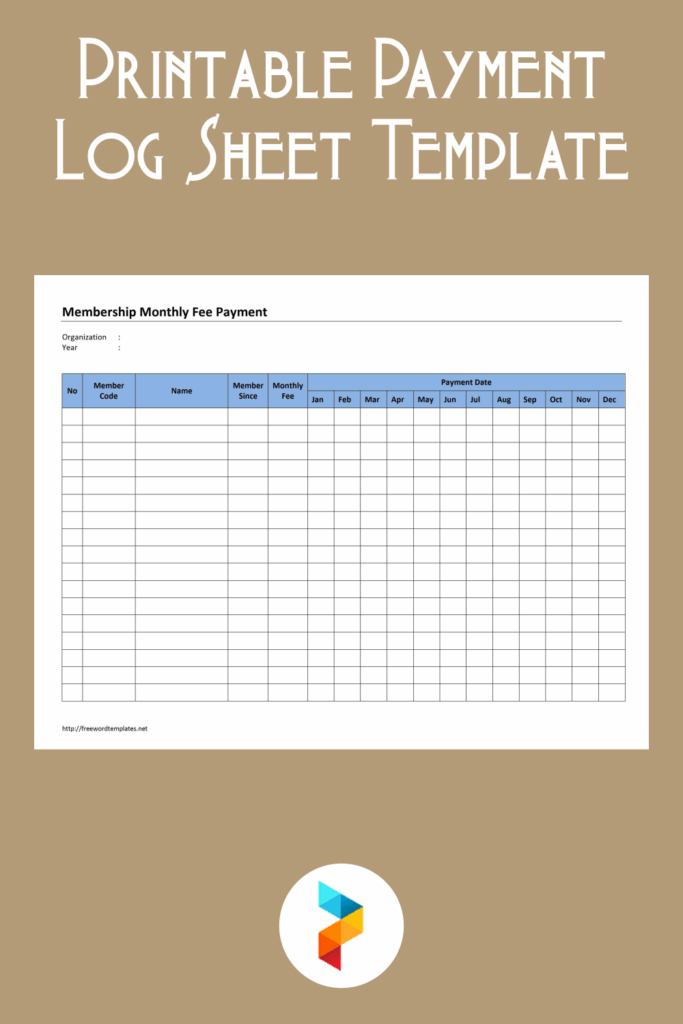

Creating a printable payment log is easy and can be done using a simple spreadsheet or template. Start by listing all your recurring payments, such as rent, utilities, and subscriptions. Include the due date, amount, and method of payment for each bill. You can also track one-time payments, such as credit card bills or medical expenses, by adding them to your log as they occur. Be sure to update your payment log regularly to ensure it remains accurate and up-to-date.

Tips for Maintaining Your Payment Log

To make the most of your printable payment log, consider implementing the following tips:

1. Set aside time each week to update your payment log with any new payments or changes to existing ones.

2. Keep your payment log in a safe and easily accessible place, such as a binder or folder, to ensure you can refer to it whenever needed.

3. Use color-coding or highlighting to differentiate between different types of payments, making it easier to identify and track specific expenses.

By following these tips and regularly updating your printable payment log, you can take control of your finances and stay on top of your payments with ease.