An accounts receivable log sheet is a document used by businesses to track and manage the money owed to them by customers. This log sheet helps businesses keep a record of all incoming payments, outstanding balances, and any overdue invoices. By maintaining an organized accounts receivable log sheet, businesses can ensure timely collection of payments and maintain strong cash flow.

Using a printable accounts receivable log sheet can provide several benefits for businesses. Firstly, a printable log sheet allows for easy access and quick updates, making it convenient for employees to record and track payments. Additionally, having a physical log sheet makes it easier to spot any discrepancies or errors in the accounts receivable process. By regularly updating and reviewing the log sheet, businesses can stay on top of their finances and ensure accurate record-keeping.

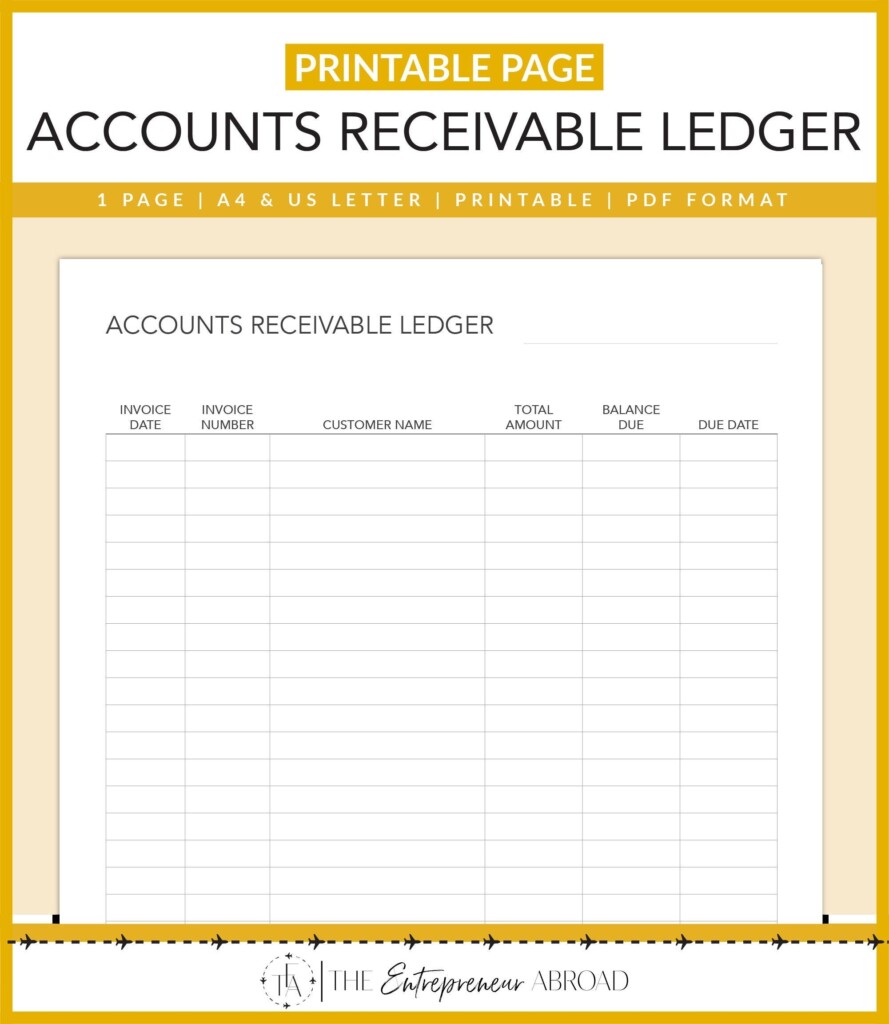

How to Utilize a Printable Accounts Receivable Log Sheet

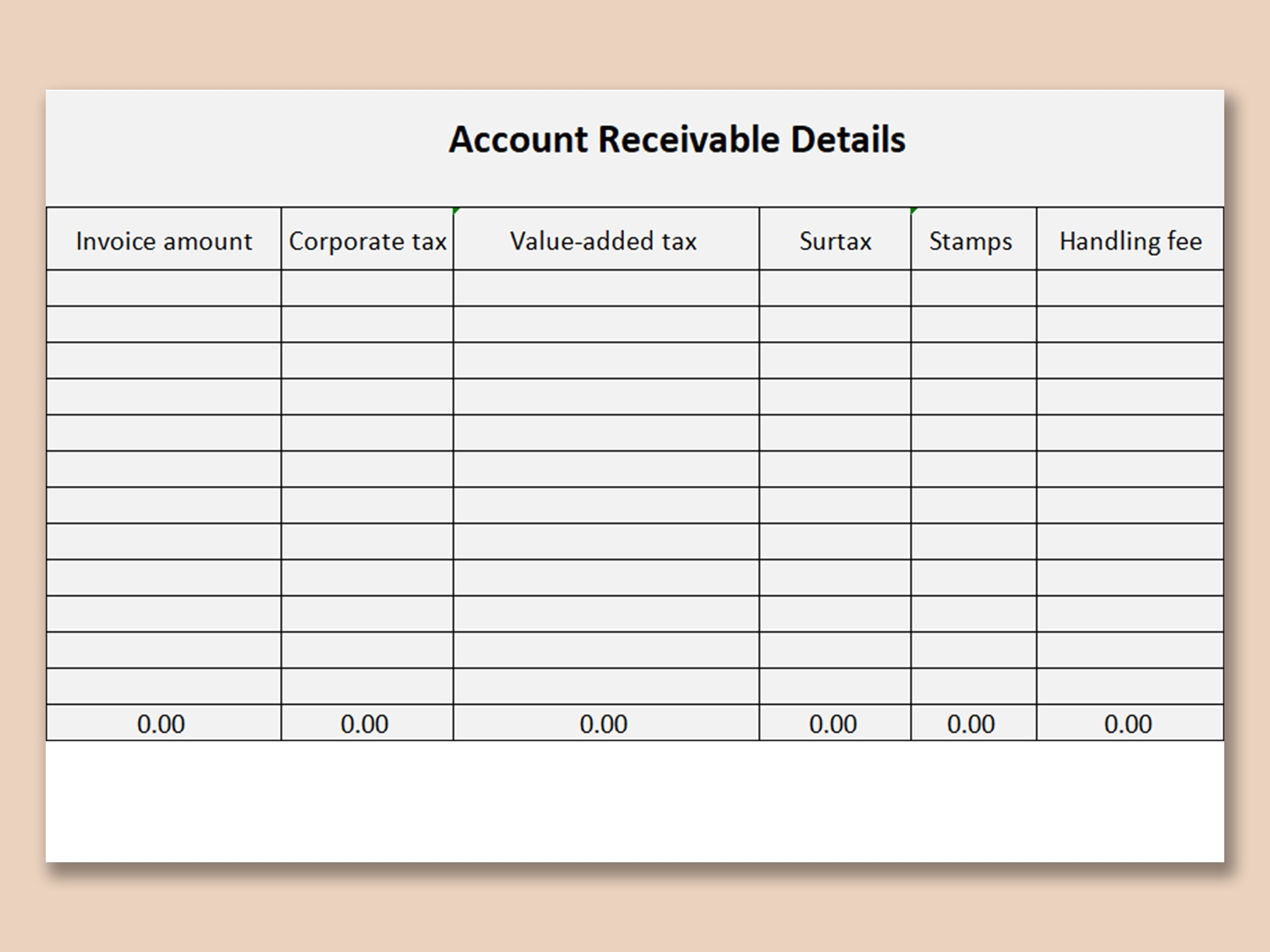

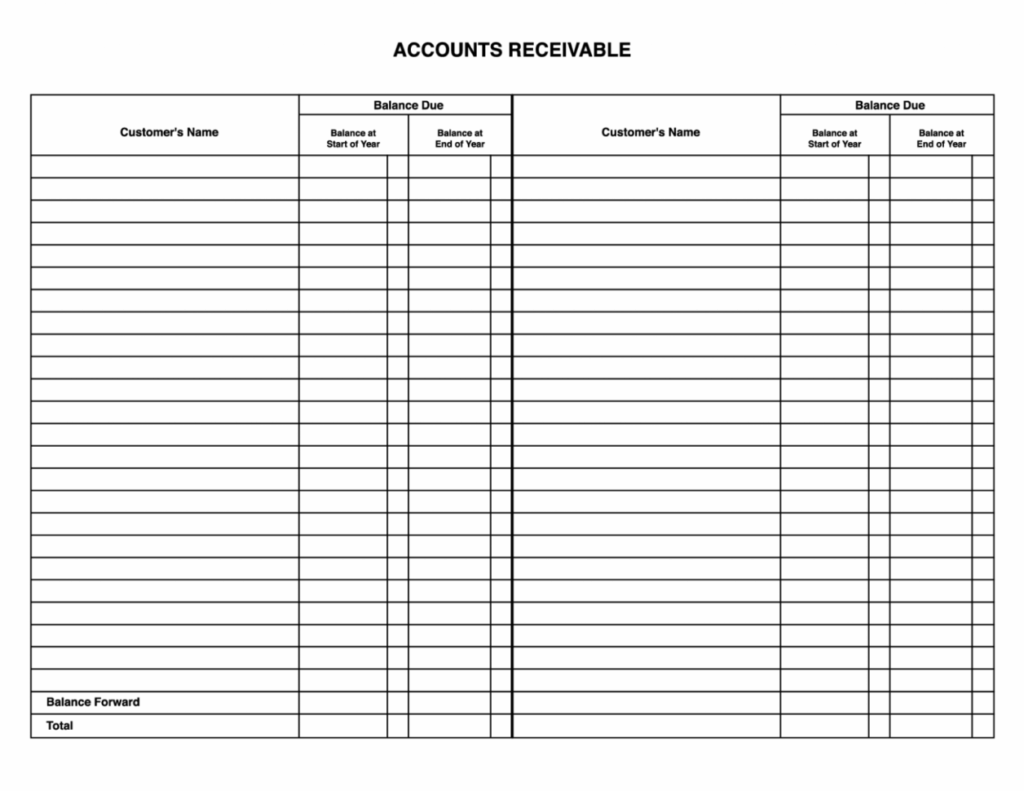

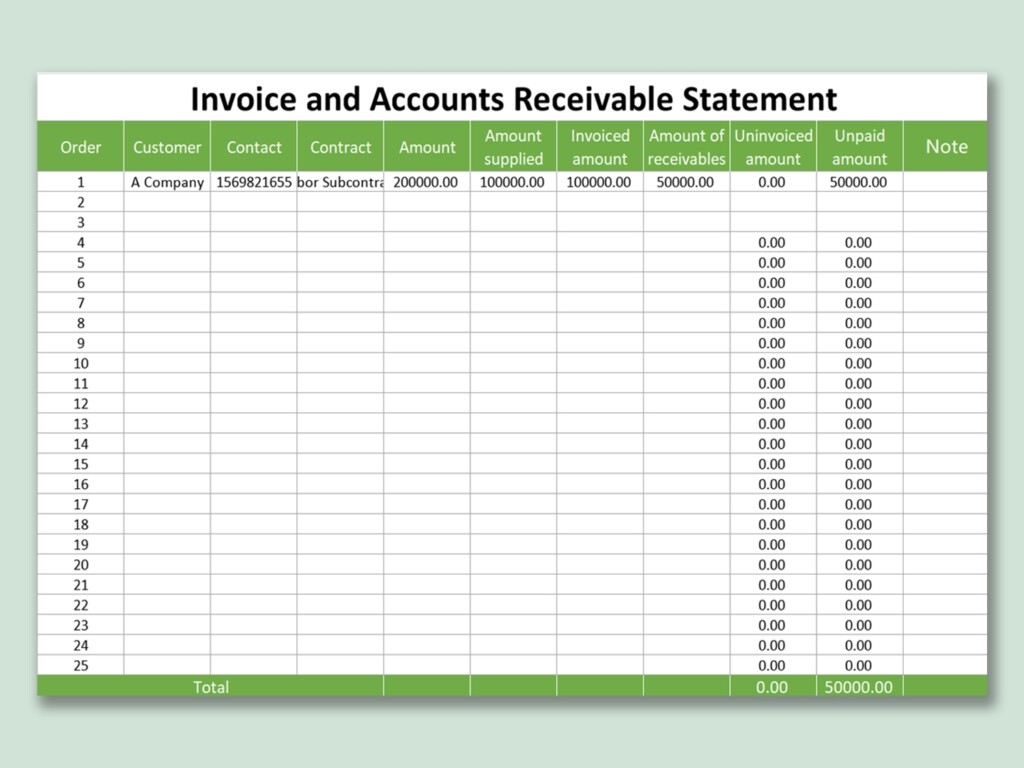

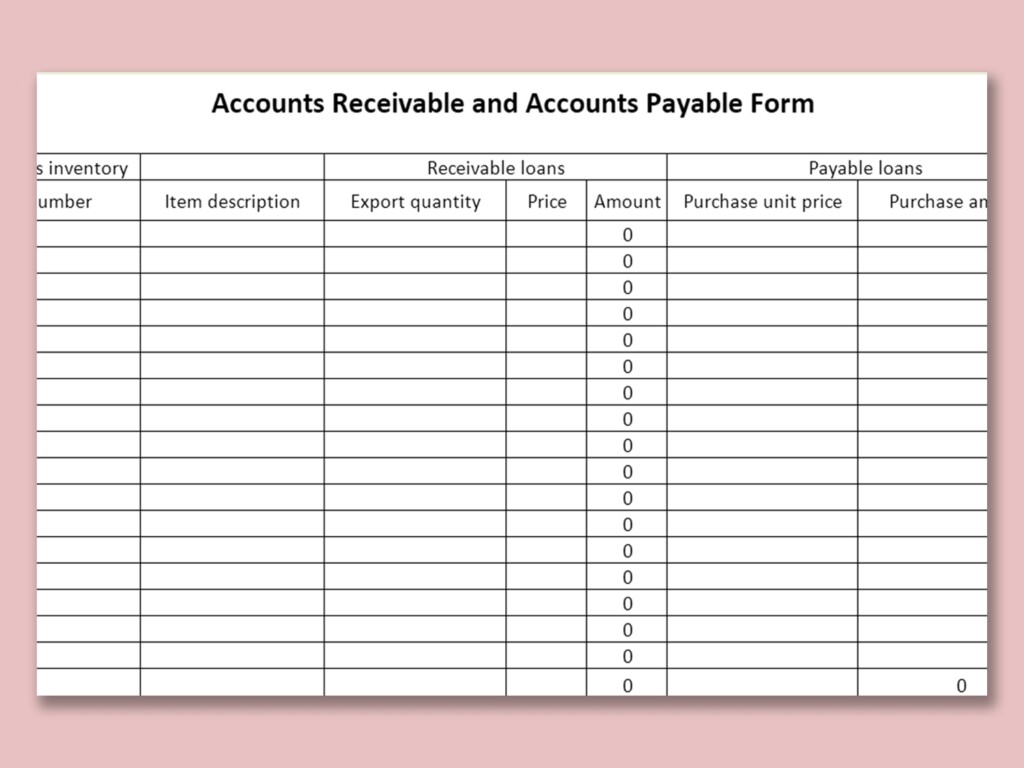

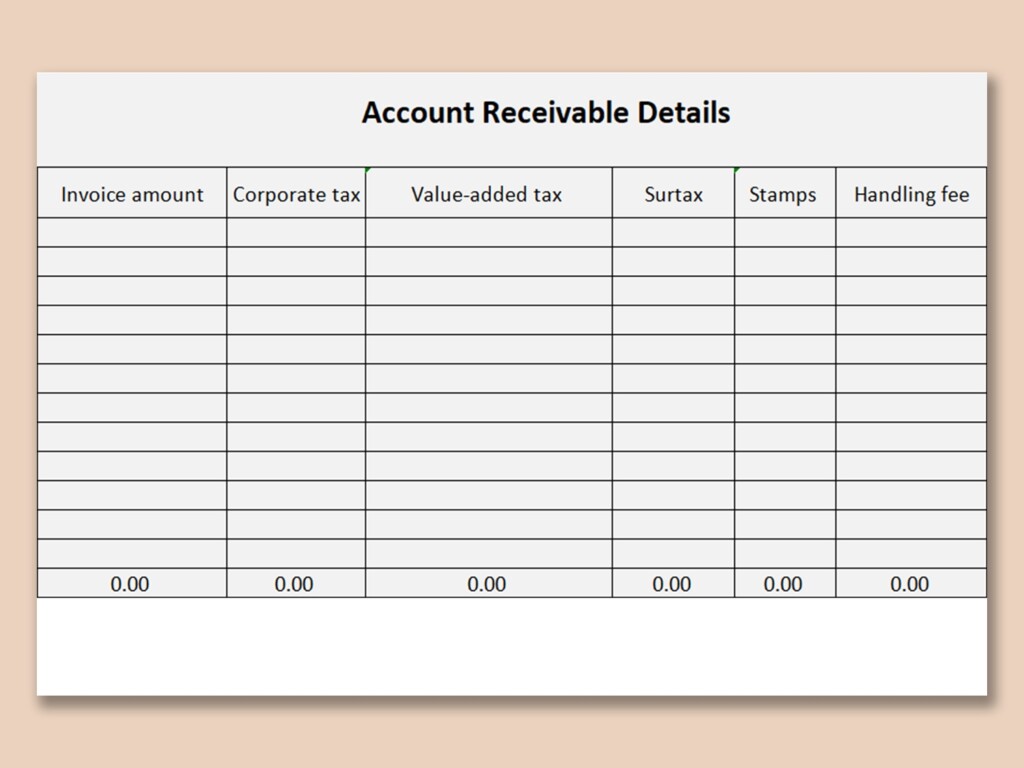

When using a printable accounts receivable log sheet, businesses should ensure that all relevant information is included, such as customer names, invoice numbers, payment amounts, and due dates. It is important to update the log sheet regularly to reflect any new payments received or outstanding balances. By keeping the log sheet organized and up-to-date, businesses can effectively track their accounts receivable and improve their overall financial management.

Conclusion

In conclusion, utilizing a printable accounts receivable log sheet is essential for businesses looking to maintain accurate records of their incoming payments and outstanding balances. By keeping a detailed log sheet, businesses can improve their cash flow management, spot any payment discrepancies, and ensure timely collection of payments. Overall, a printable accounts receivable log sheet is a valuable tool for businesses of all sizes to effectively track and manage their accounts receivable.