A printable mileage log is a document used to track the number of miles driven for business purposes. It is essential for individuals who need to keep accurate records of their travel expenses for tax purposes or reimbursement from their employer. By keeping a detailed mileage log, you can easily calculate your total mileage and expenses at the end of the year.

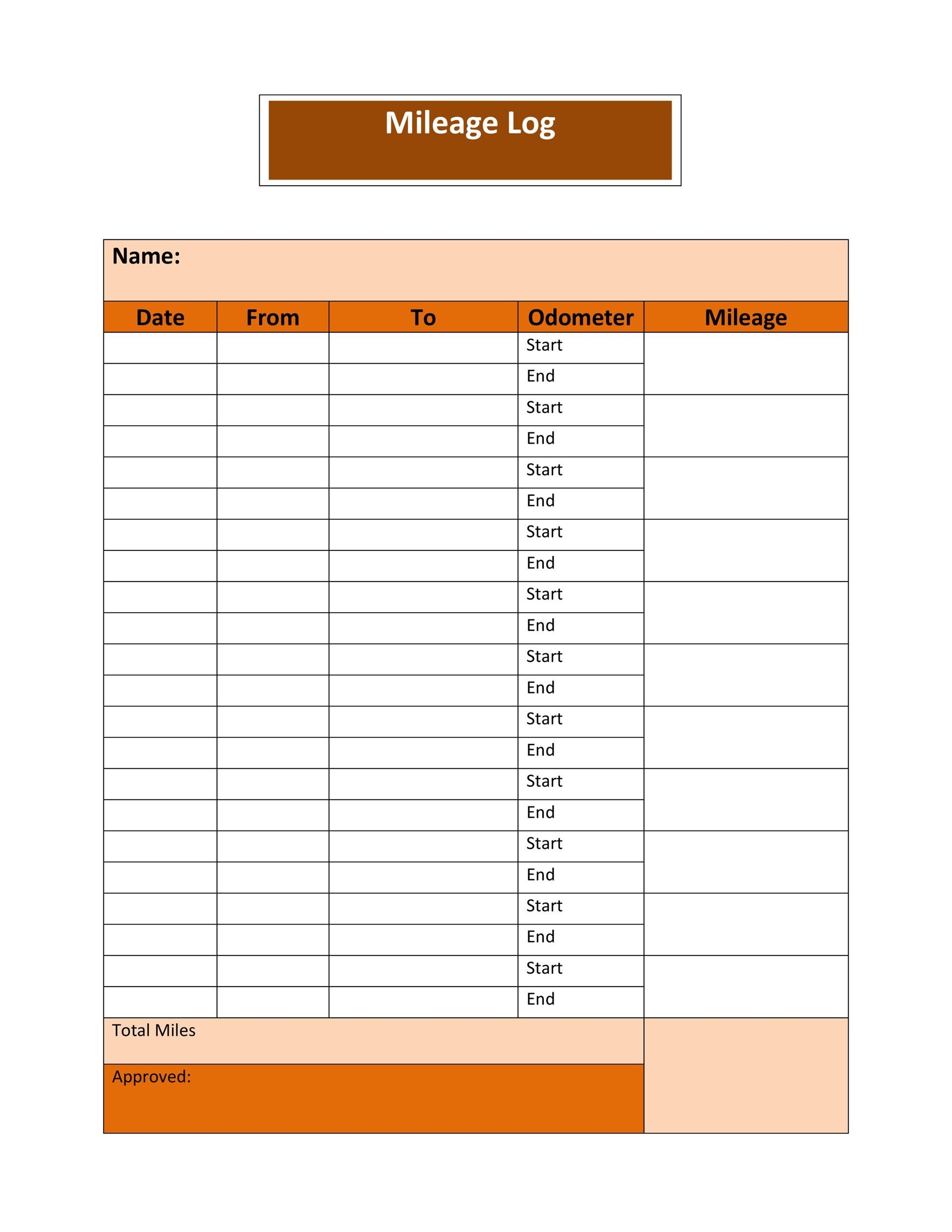

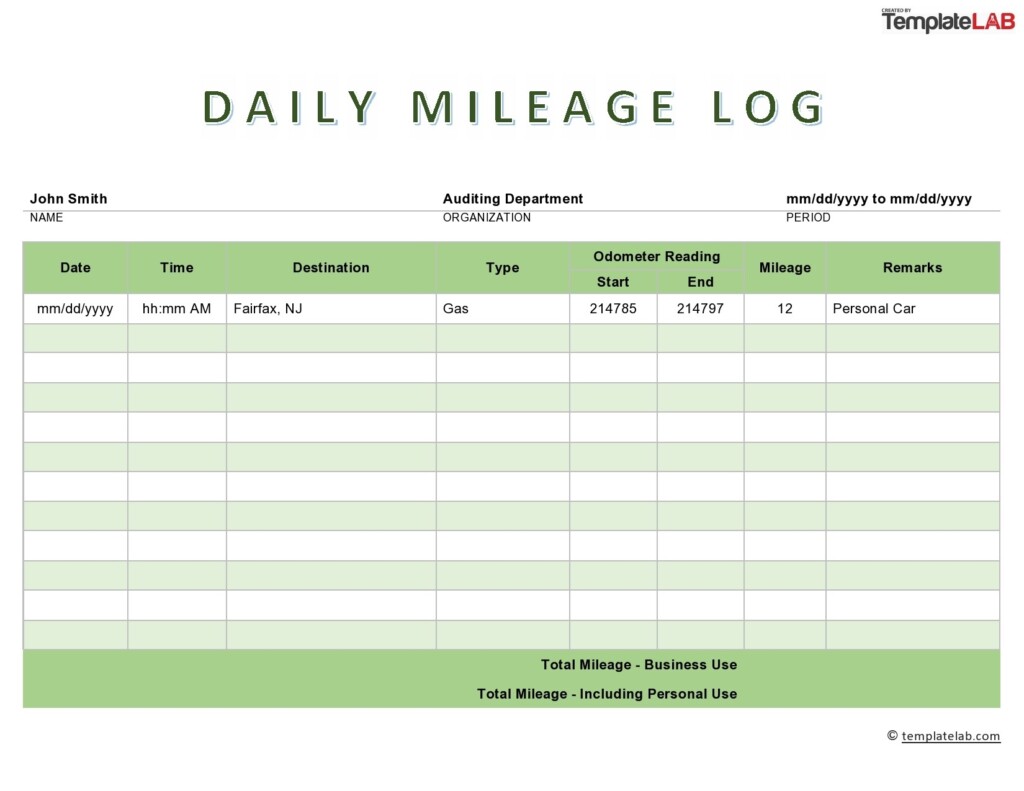

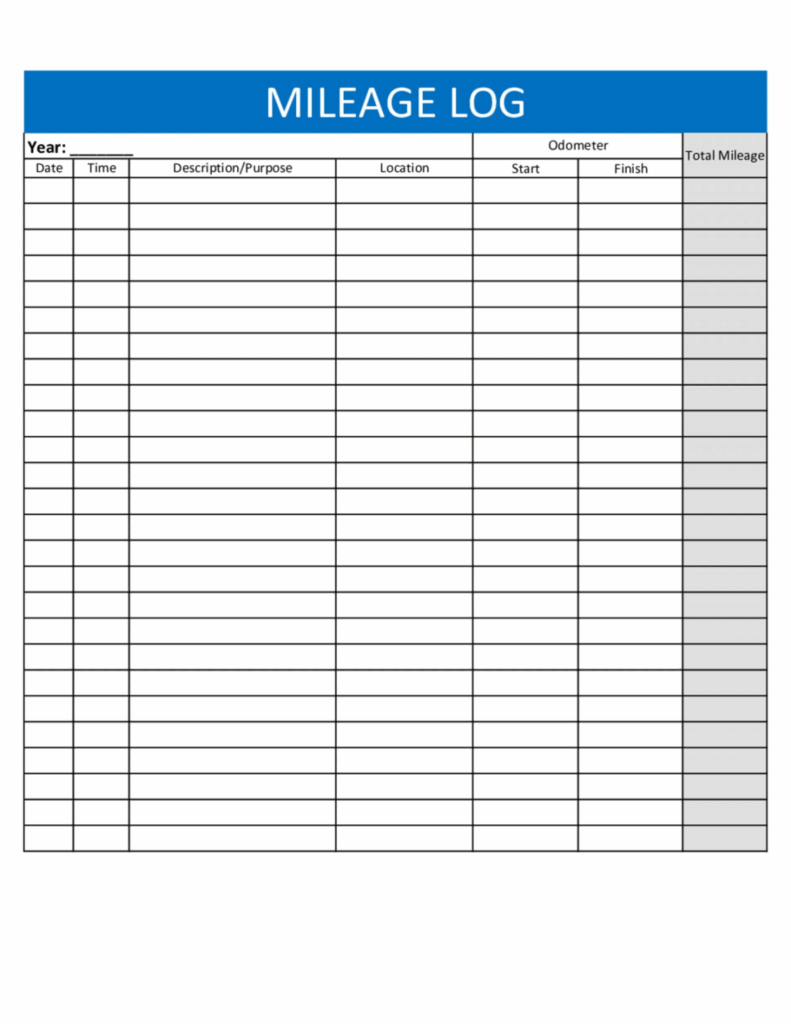

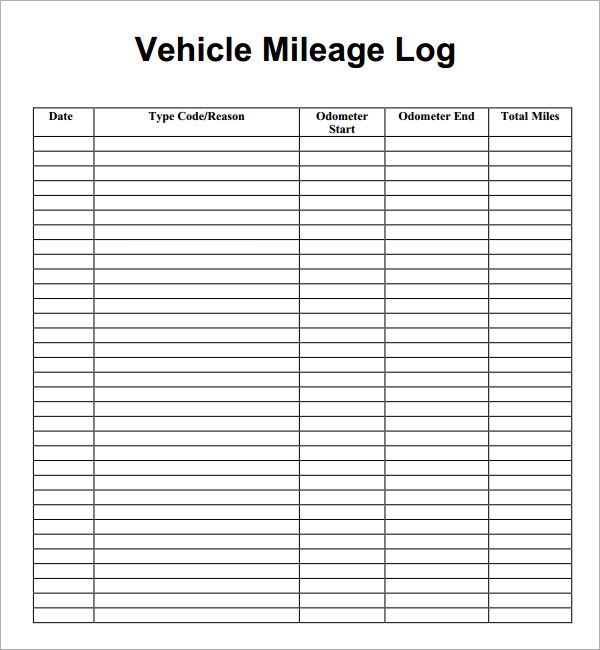

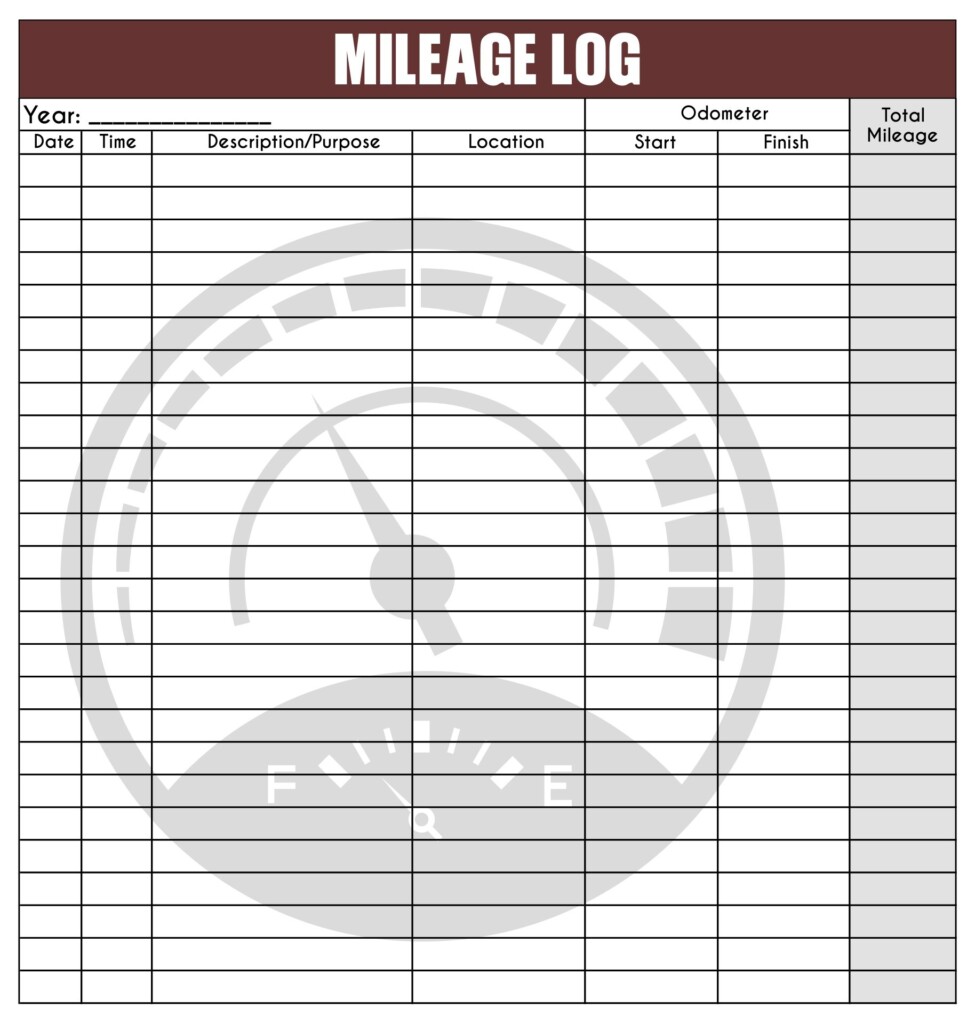

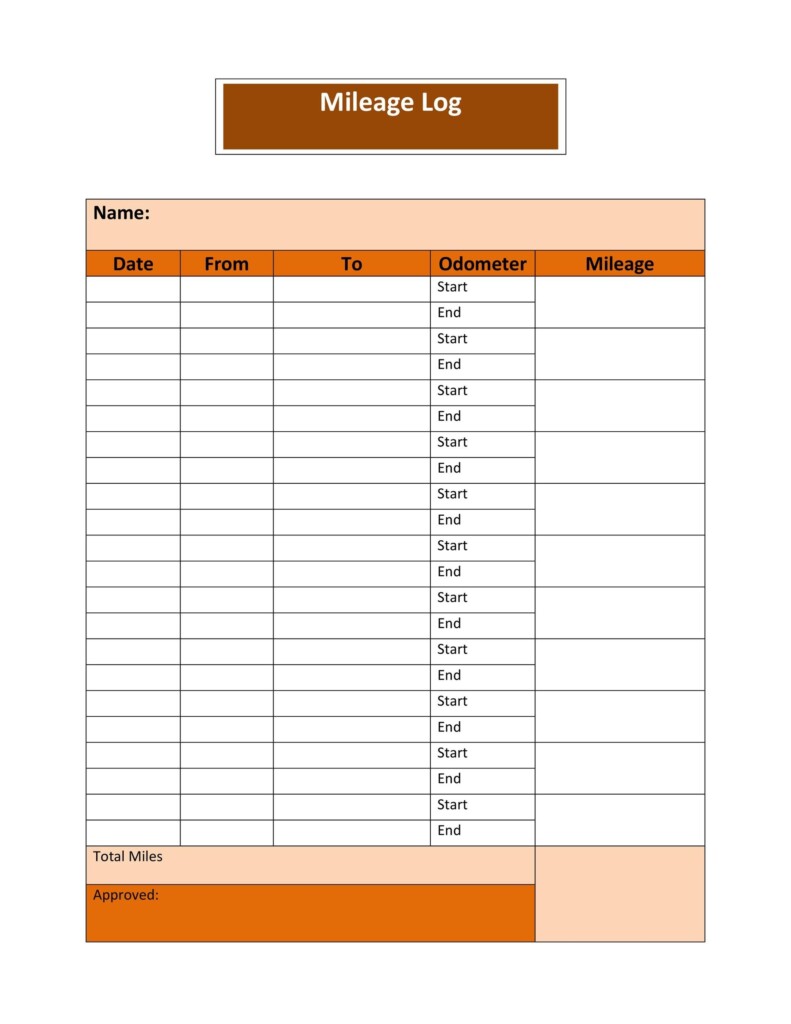

There are various printable mileage log templates available online that you can use to record your mileage. These templates typically include fields for date, starting and ending locations, purpose of the trip, total miles driven, and any additional notes. By using a printable mileage log, you can ensure that you have all the necessary information to support your claims.

Benefits of Using a Printable Mileage Log

Using a printable mileage log offers several benefits, including:

1. Tax Deductions: Keeping a detailed mileage log can help you maximize your tax deductions by accurately tracking your business-related travel expenses.

2. Reimbursement: If you are required to travel for work, a mileage log can help you claim reimbursement from your employer for the miles driven on business trips.

How to Use a Printable Mileage Log

To effectively use a printable mileage log, follow these steps:

1. Record all business-related trips in your mileage log, including the date, starting and ending locations, purpose of the trip, and total miles driven.

2. Keep your mileage log updated regularly to ensure accurate and up-to-date records.

3. Use a separate log for personal and business-related trips to avoid confusion and maintain accurate records.

4. Store your mileage log in a safe place to prevent loss or damage, as you may need to refer to it during tax season or when seeking reimbursement.

By using a printable mileage log, you can easily track your business-related travel expenses and ensure that you are properly reimbursed for your mileage. Make sure to choose a template that suits your needs and preferences to make the tracking process as seamless as possible.