A printable mileage log for taxes is a document used to track and record the number of miles driven for business purposes. This log is essential for self-employed individuals, freelancers, and employees who use their personal vehicles for work-related trips. By keeping a detailed mileage log, individuals can accurately calculate their deductible mileage expenses for tax purposes.

Using a printable mileage log can help individuals save money on their taxes by claiming deductions for business-related mileage. The log should include information such as the date of the trip, starting and ending locations, purpose of the trip, and total miles driven. By maintaining a comprehensive mileage log throughout the year, individuals can easily provide the necessary documentation to support their tax deductions.

How to Create a Printable Mileage Log for Taxes

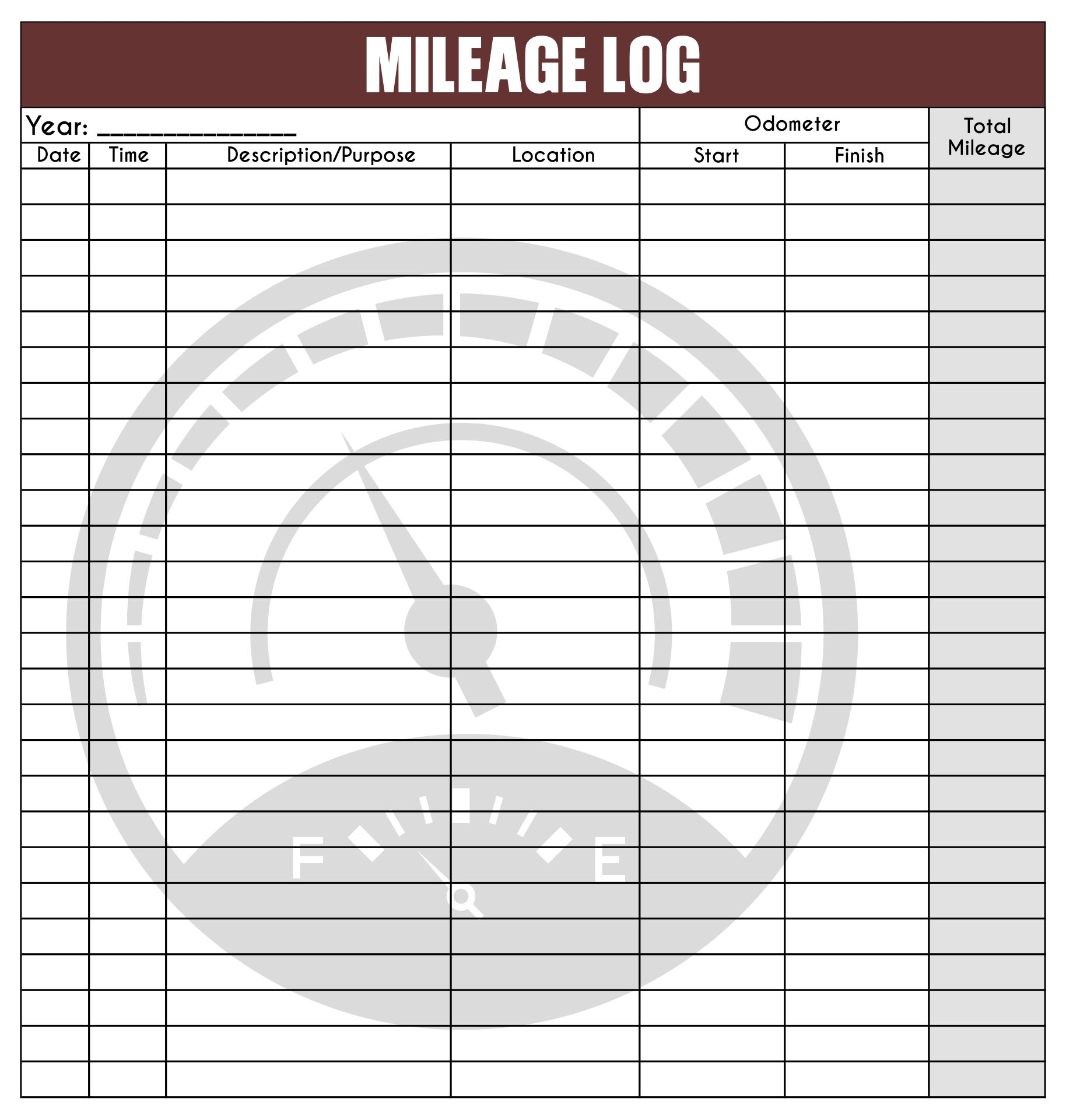

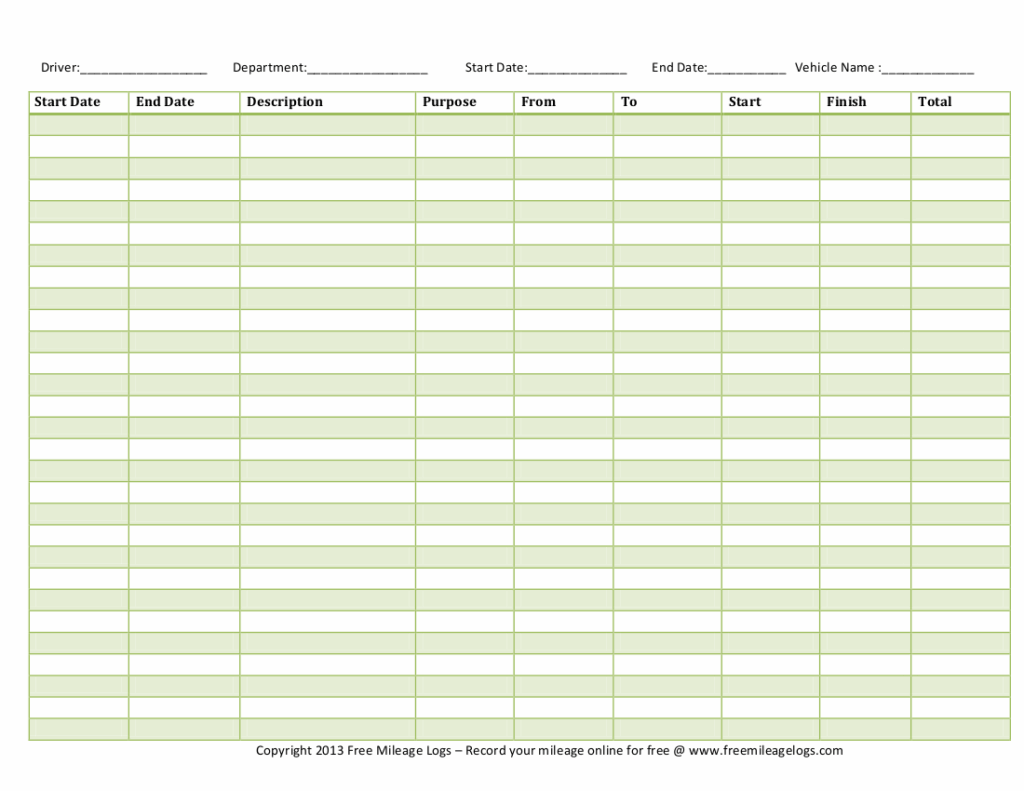

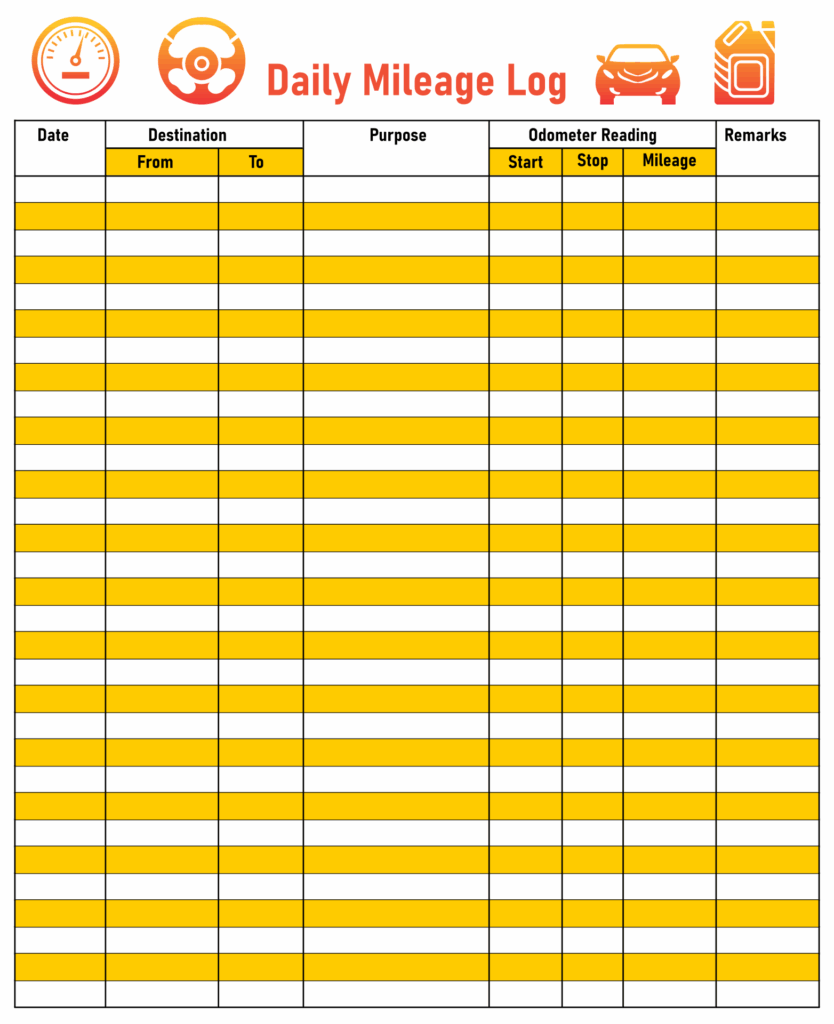

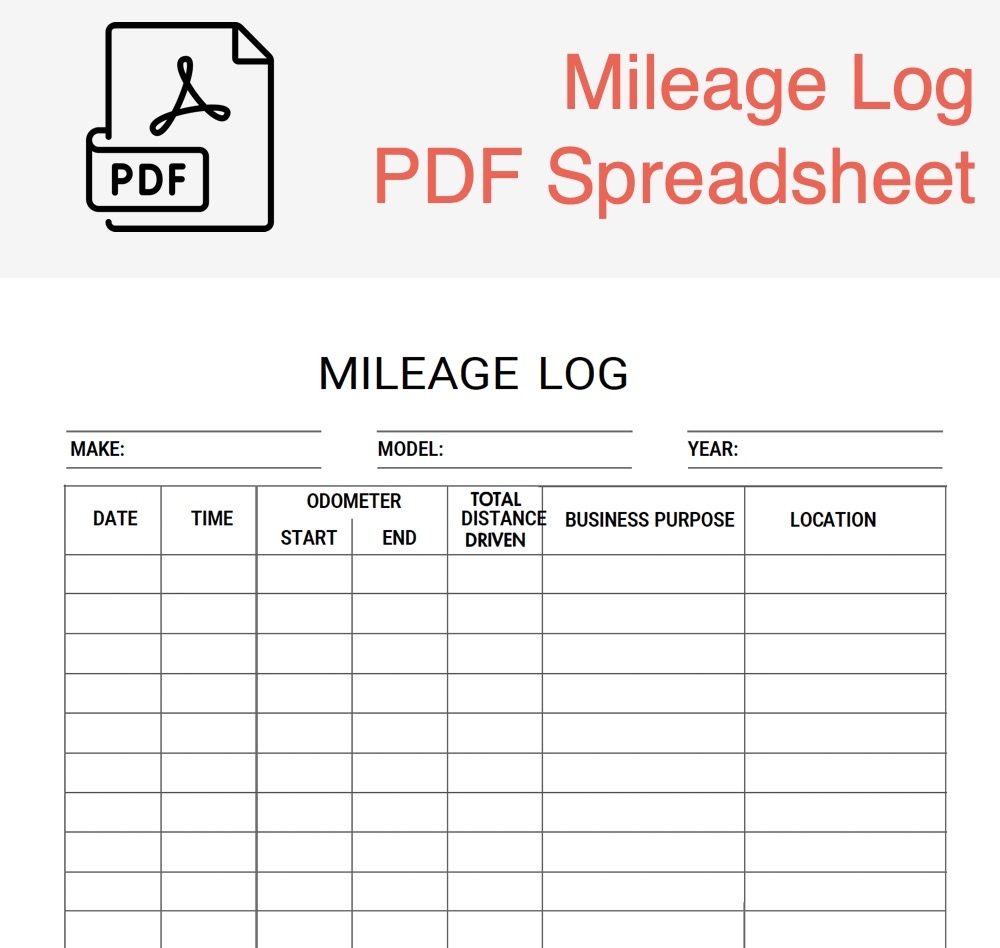

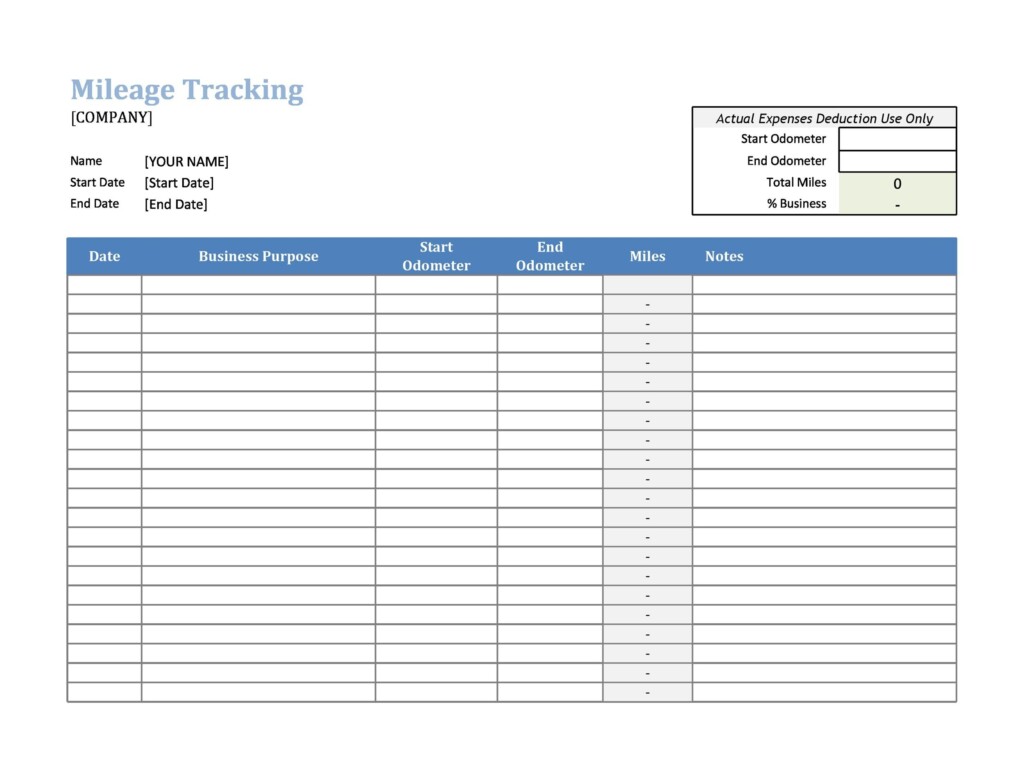

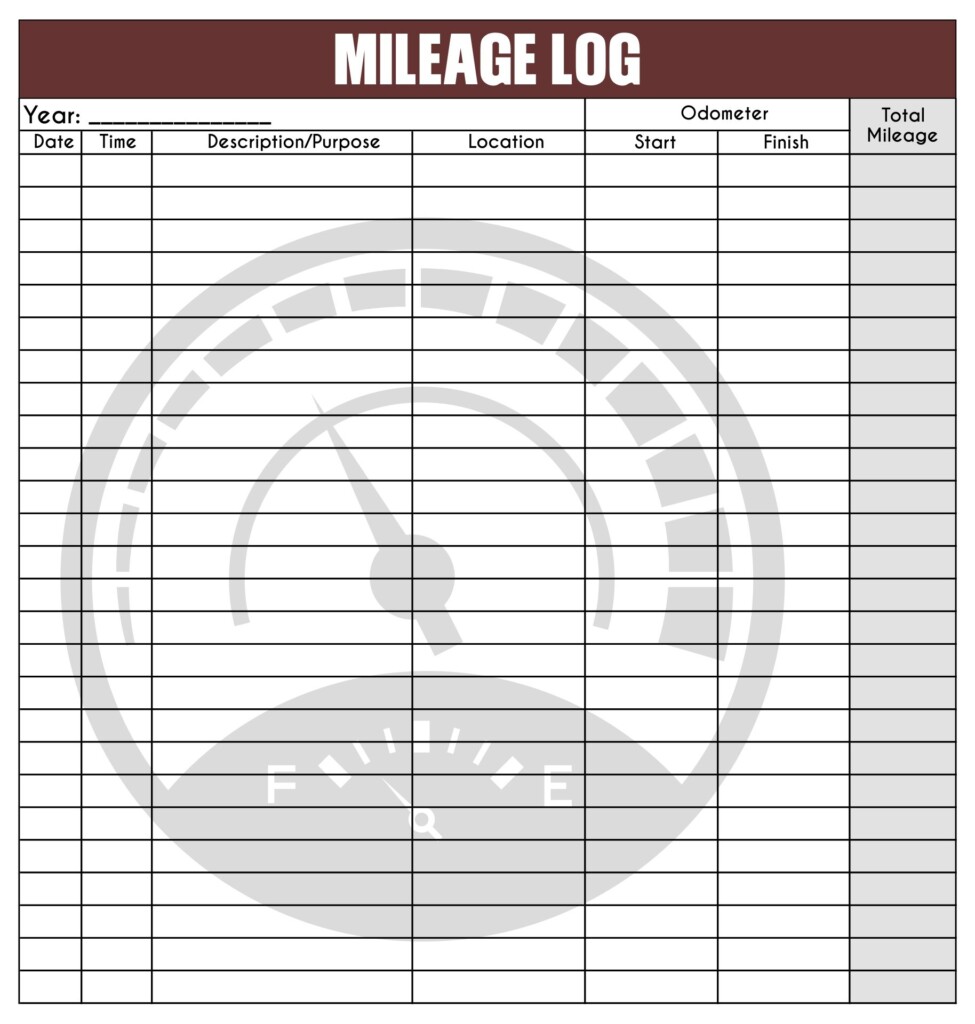

Creating a printable mileage log for taxes is simple and straightforward. Start by downloading a template or creating a spreadsheet with columns for the necessary information, such as date, starting location, ending location, purpose of the trip, and total miles driven. Print out multiple copies of the log to keep in your vehicle for easy access.

Each time you take a business-related trip, fill out the relevant information in the mileage log. Be sure to record the odometer readings at the beginning and end of each trip to calculate the total miles driven. At the end of the year, total up your deductible mileage expenses and include this information on your tax return. By keeping accurate and detailed records, you can confidently claim your mileage deductions and potentially save money on your taxes.

Benefits of Using a Printable Mileage Log

There are several benefits to using a printable mileage log for taxes. First and foremost, keeping a detailed log of your business-related mileage can help you accurately calculate your deductible expenses and potentially save money on your taxes. Additionally, having a mileage log can provide peace of mind in the event of an IRS audit, as you will have documented proof of your mileage expenses.

Using a printable mileage log can also help you stay organized and track your business-related expenses more effectively. By consistently recording your mileage, you can easily identify patterns in your driving habits and make adjustments to optimize your mileage deductions. Overall, a printable mileage log is a valuable tool for anyone who uses their personal vehicle for work-related purposes and wants to maximize their tax savings.