A printable mileage log template for self-employed individuals is a useful tool for tracking business-related travel expenses. Whether you are a freelancer, independent contractor, or small business owner, keeping accurate records of your mileage can help you maximize tax deductions and better manage your finances.

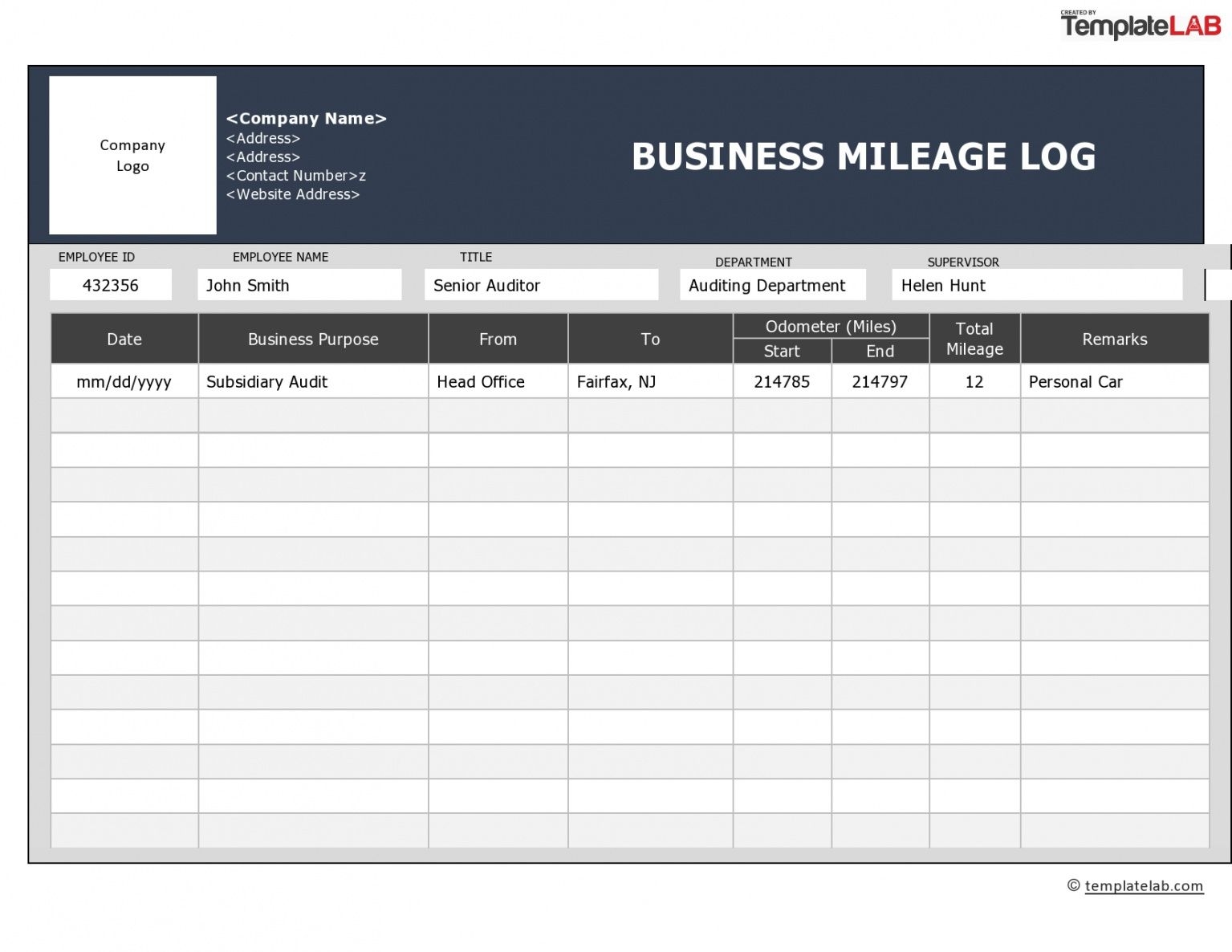

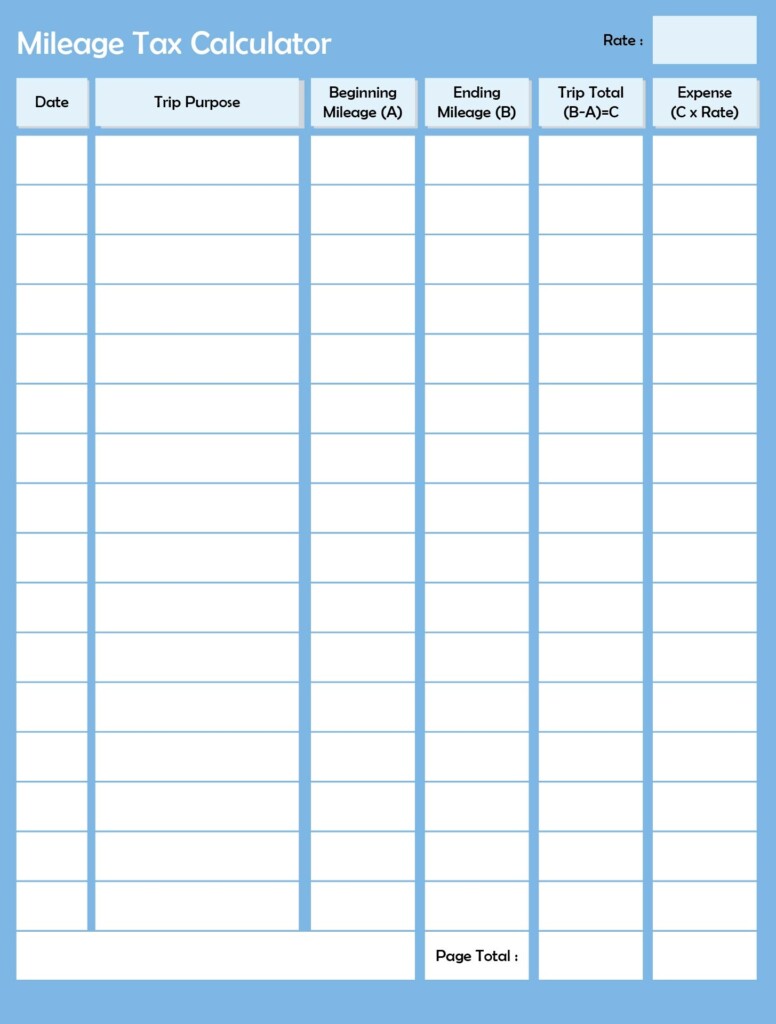

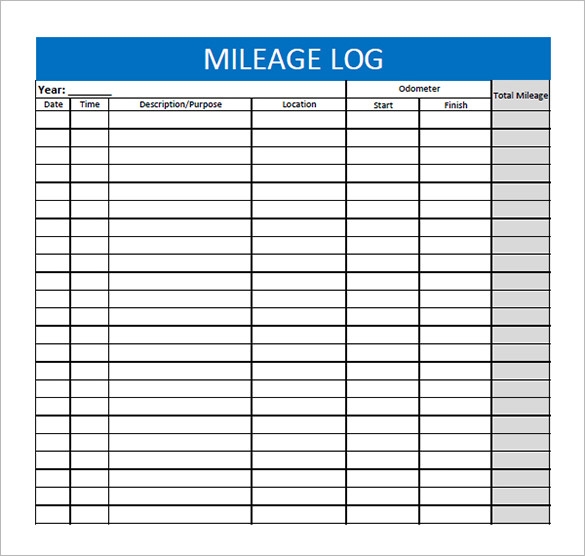

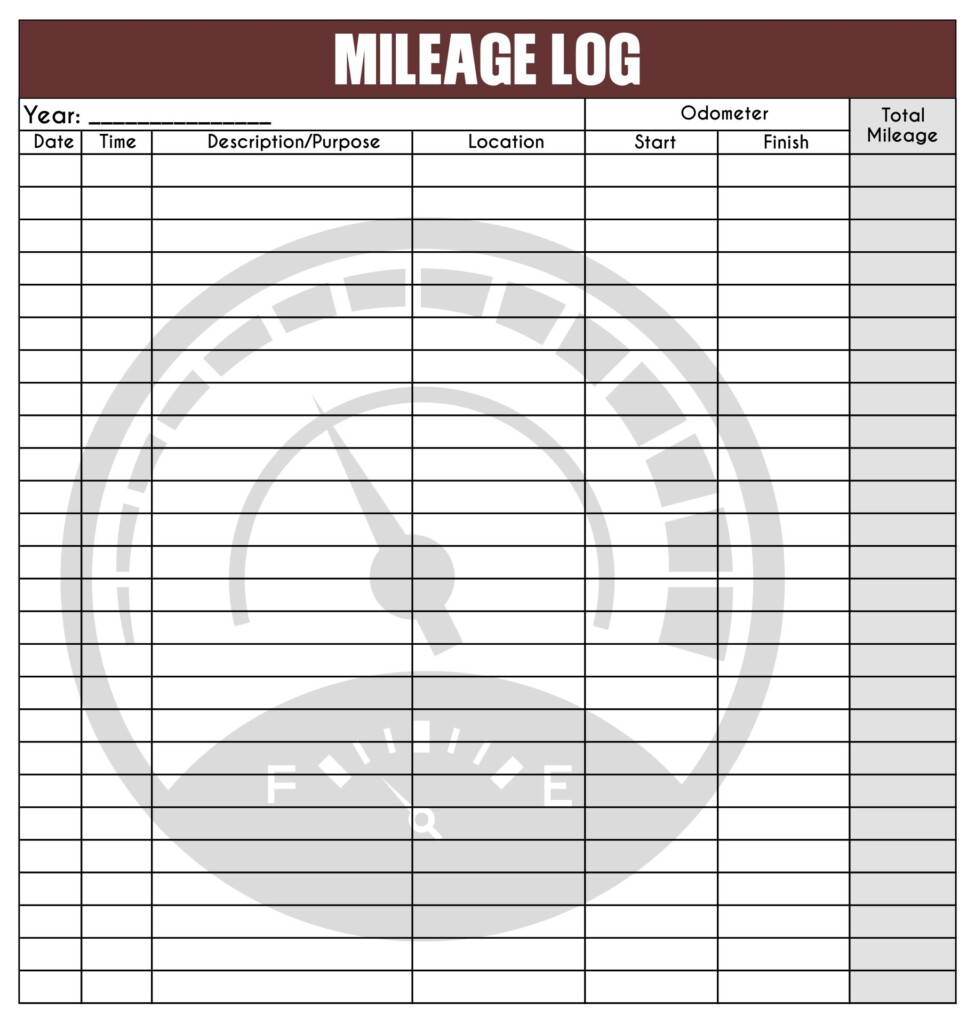

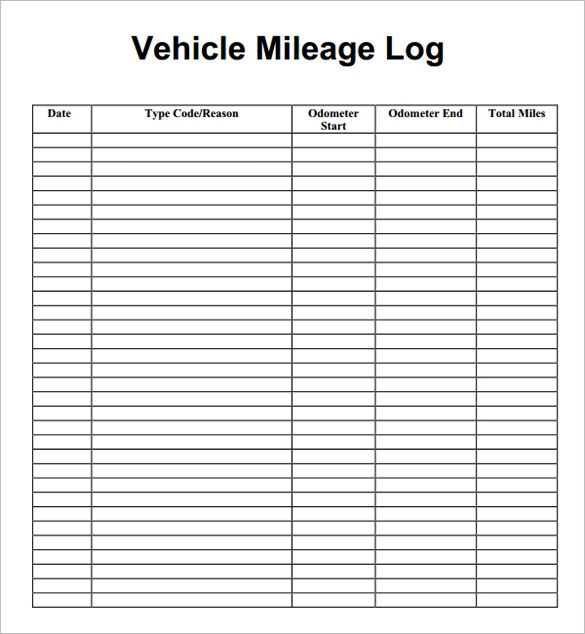

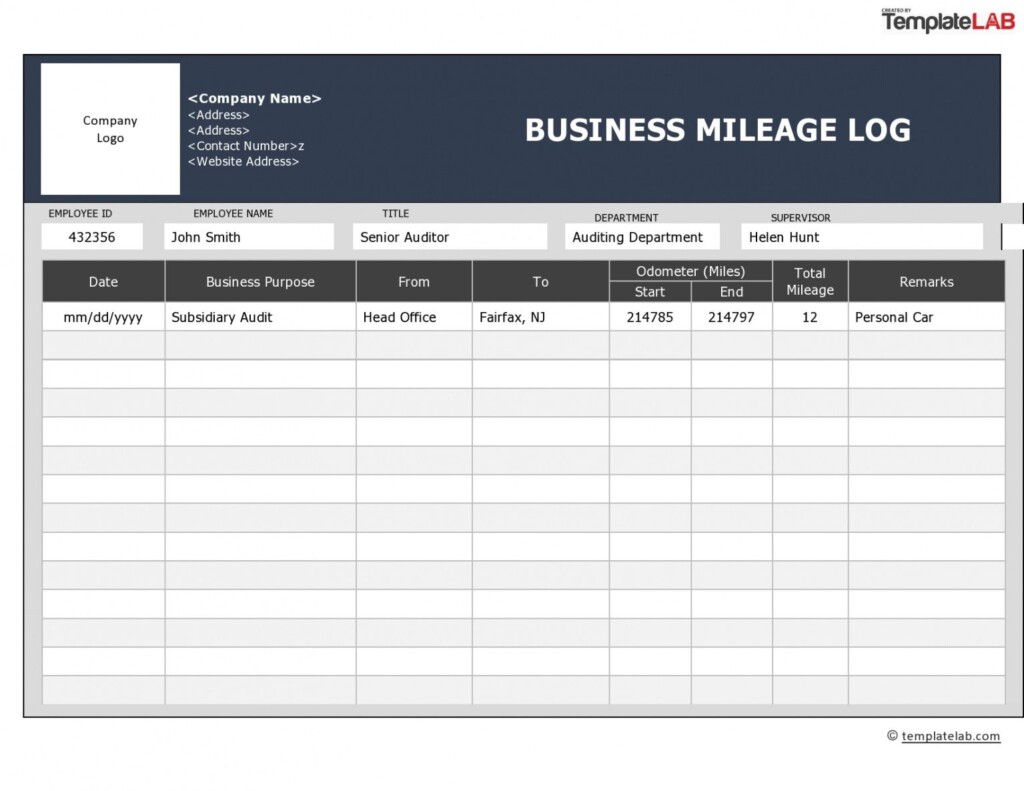

By using a mileage log template, you can easily record essential information such as the date of travel, starting and ending locations, purpose of the trip, and total miles driven. This documentation can be invaluable when it comes time to report your expenses to the IRS or calculate reimbursements from clients.

Benefits of Using a Printable Mileage Log Template

There are several benefits to using a printable mileage log template for self-employed individuals. Firstly, it can help you save time and effort by providing a structured format for recording your travel expenses. Instead of trying to remember details about each trip, you can simply fill in the necessary information as you go.

Additionally, a mileage log template can help you stay organized and ensure that you are accurately tracking your business-related mileage. This can help you avoid costly mistakes and potential audits by providing clear documentation of your expenses. Lastly, using a mileage log template can help you maximize your tax deductions by ensuring that you are claiming all eligible expenses.

How to Use a Printable Mileage Log Template

Using a printable mileage log template is simple and straightforward. Start by downloading a template that suits your needs and preferences. Next, fill in the necessary information for each trip, including the date, starting and ending locations, purpose of the trip, and total miles driven.

Be sure to keep your mileage log updated regularly and store it in a safe place for easy access. At the end of the year, you can use your mileage log to calculate your total business-related miles and expenses for tax purposes. By using a printable mileage log template, you can simplify the process of tracking your travel expenses and ensure that you are maximizing your deductions as a self-employed individual.

By incorporating a printable mileage log template into your routine, you can streamline your record-keeping process and make tax time less stressful. Whether you are self-employed full-time or part-time, having accurate documentation of your business-related mileage is essential for managing your finances effectively. Download a printable mileage log template today and start tracking your travel expenses with ease.