For self-employed individuals, keeping track of mileage is crucial for tax purposes and business expenses. A mileage log helps you accurately calculate your deductible expenses and provides proof in case of an audit. By maintaining a detailed mileage log, you can ensure that you are maximizing your deductions and complying with IRS regulations.

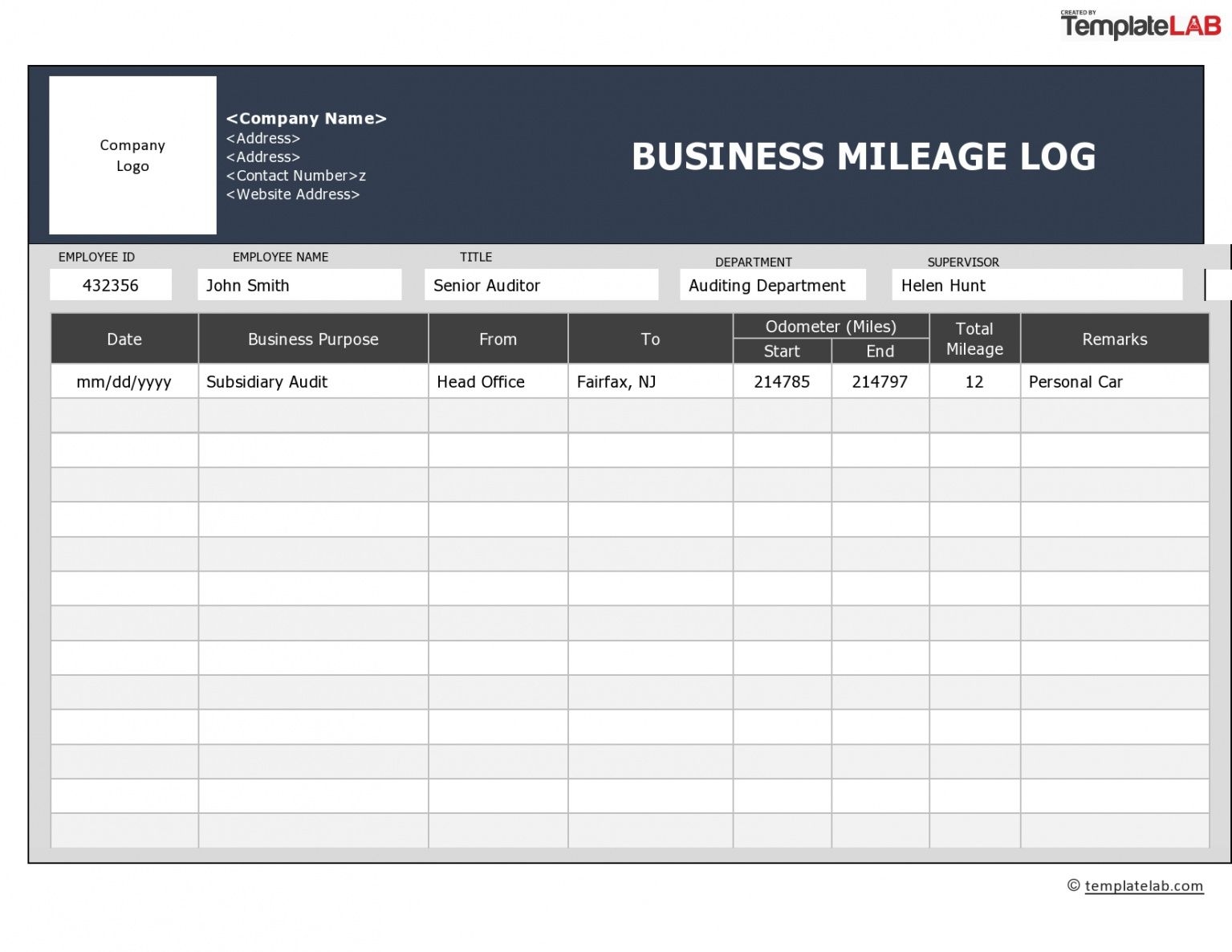

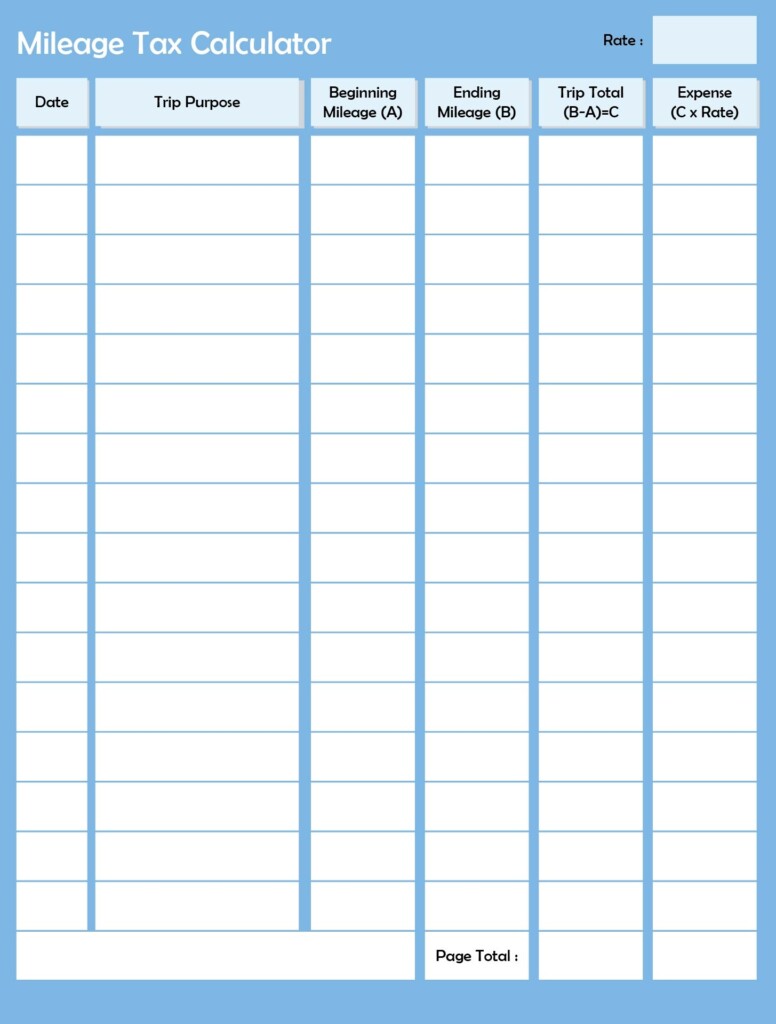

Using a printable mileage log template can make this task much easier and organized. With a template, you can easily record the date, starting and ending locations, purpose of the trip, and total miles driven for each business-related journey.

How to Use a Printable Mileage Log Template

When using a printable mileage log template, start by entering the date of the trip at the top of the log. Then, record the starting point and destination of the trip, along with the purpose (e.g., client meeting, supply pickup). Next, document the total miles driven for that trip.

It’s important to be consistent and accurate when filling out your mileage log. Make sure to update it regularly, ideally after each trip, to ensure that you don’t forget any important details. At the end of the year, you’ll have a comprehensive record of your business-related mileage that you can use for tax purposes.

Download Our Free Printable Mileage Log Template

To help self-employed individuals track their mileage effectively, we have created a free printable mileage log template. This template is designed to be user-friendly and customizable, allowing you to easily input your trip details and calculate your total mileage.

Download our printable mileage log template today and take the first step towards better tracking your business mileage and maximizing your tax deductions!